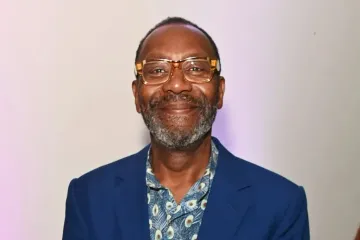

Warren Buffett: A Titan of Finance and Philanthropy

Warren Buffett, often called the “Oracle of Omaha,” is regarded as one of the most successful investors of all time. His investment strategies and deep commitment to philanthropy have earned him widespread respect in both the financial world and beyond. Buffett’s journey from a young boy with an early interest in business to a billionaire investor and generous philanthropist is an enduring testament to his prowess and values.

The Investment Genius of Berkshire Hathaway

Buffett’s name is synonymous with Berkshire Hathaway, the multinational conglomerate he transformed from a struggling textile company into a financial powerhouse. His value investing philosophy, heavily inspired by Benjamin Graham, has guided his decades-long success. Buffett’s approach is marked by patience, discipline, and a keen eye for undervalued companies. His notable investments in companies like Coca-Cola, American Express, and Apple demonstrate his strategic acumen. By choosing to reinvest profits rather than distribute dividends, Buffett has continually increased Berkshire Hathaway’s shareholder value.

A Life of Humble Beginnings and Astounding Wealth

Buffett’s financial success is rooted in humble beginnings. Born in 1930 in Omaha, Nebraska, Buffett showed a keen interest in business from an early age, famously buying his first stock at 11 and filing his first tax return at 13. His early experiences shaped a lifelong commitment to investing and led to his rise as one of the world’s wealthiest individuals, with a net worth exceeding $100 billion. Despite his immense wealth, Buffett is known for his modest lifestyle and frugal habits, living in the same house he bought in the 1950s.

Philanthropy and the Giving Pledge

Buffett’s commitment to giving back is as impressive as his financial achievements. In 2010, he co-founded the Giving Pledge with Bill Gates, encouraging billionaires to dedicate at least half of their wealth to charitable causes. True to his word, Buffett has pledged to donate over 99% of his fortune and has already given tens of billions of dollars, primarily to the Bill & Melinda Gates Foundation. His philanthropic focus extends to areas like global health, poverty alleviation, and education, showcasing his belief in using wealth to create positive change.

Enduring Influence in Finance

Buffett’s influence reaches far beyond his own investments. His annual letters to Berkshire Hathaway shareholders are widely studied by investors and business professionals for their insights into finance, market trends, and economic philosophy. Known for his straightforward and candid writing style, Buffett distills complex concepts into digestible advice, reinforcing his role as a mentor to countless financial enthusiasts and industry leaders. His emphasis on long-term investing and prudent financial management continues to shape investment strategies globally.

A Legacy of Wisdom and Integrity

Buffett’s reputation is built not only on his financial acumen but also on his unwavering integrity. He famously advises, “It takes 20 years to build a reputation and five minutes to ruin it.” This guiding principle has earned him trust and admiration across industries. His decision-making, guided by honesty and sound ethics, sets an example of leadership that prioritizes both profitability and moral responsibility. As a result, Buffett’s legacy extends beyond his wealth; it encompasses a blueprint for ethical, impactful investing.

Warren Buffett’s story is one of ambition, insight, and generosity. His legacy as an investor and philanthropist continues to inspire those in finance and beyond, reminding the world that wealth can be a tool for creating lasting, positive impact.